Reducing complexity without losing substance in the i3D Protocol

In any system, one of the most difficult things is trying to explain a complex protocol in simple terms. Let’s have a shot at it…

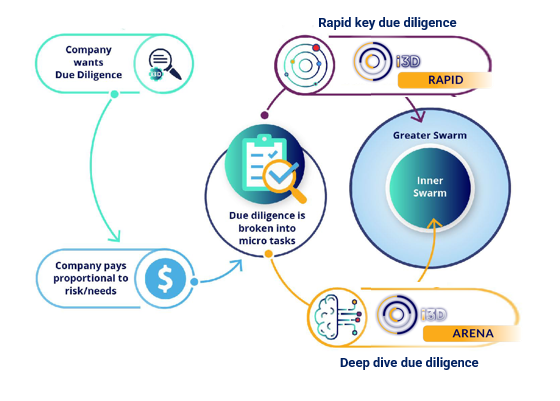

The i3D Protocol is a double-sided marketplace: on one side a network of experts in different fields sharing their expertise to analyse alpha start-ups, and on the other side investors who want the data.

Four key points:

1. As an expert you buy and stake i3D Tokens to grant you access to doing the work/analysis with its integrity protected by how much is staked by the analyst and their reputation being managed by tracking algorithms. On completion analysts get their staked tokens plus new i3D Tokens.

2. Investors who want lifelong access to the data buy an i3D Angel NFT (this replaces a traditional subscription model)

3. A Liquidity pool is created when we sell NFTs and i3D Tokens. These proceeds are invested into a Capital Preserving Stablecoin Fund and the yields are used to pay the experts i3D Tokens (through issue & buyback mechanisms) and/or invest in identified alpha opportunities

4. Any investments made by the Fund are reflected in an Index Token with the i3D Protocol owning their share of it- other external parties can also invest in the fund. This creates greater value in the Fund which in turn increases the value of the i3D Token.

That’s the i3D Protocol Marketplace as simple as we can make it!!

Follow us on: