Exporing Defi in bite size chunks

by Shimon Newmann and Mike Doyle

(Edit 5 April 2022) As of today the Total Market Cap of the Defi Industry is Market Cap: $2,165,446,700,623

The “decentralized finance” industry (DeFi) has exploded in value! Central to the advent of DeFi is the pursuit of “Yield”, with enormous opportunities present in this new battleground of value if you know what you are doing, but also many dangers if you do not.

As part of its research and development into investment verticals, Invluencer Ltd will begin to analyze blockchain ventures for the benefit of its subscribers with easy-to-understand steps and processes for accessing the best ways to generate passive income or high ROIs. We are currently working on using the existing scoring framework and working through the modifications for a Crypto Vertical, either as a standalone or as an integrated part of i3D. Part of understanding the whole process is knowing the mechanics of transacting on the various exchanges on which Crypto operates. We will be delving into this as part of an educational series beginning with the basics.

Interacting in the Defi space

If you want to interact with decentralized finance, you are going to need to pick up some “Ethereum” or “BNB”. Ethereum (or ETH) powers the Ethereum blockchain and BNB powers the Binance blockchain. They serve as “gas” for these systems and are needed to perform any transactions. We will explore the differences between ETH and BNB in another blog post.

Based on the methodologies that our i3D Arena & i3D Rapid Networks will use to score projects and i3D Angel NFT holders will use to access the project data you will have a tool in your hands to make a better decision based on Wisdom of the Crowd.

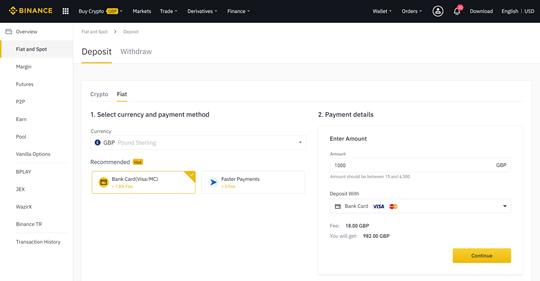

We will be walking you through the safest, cheapest, and easiest ways to acquire these in-demand crypto assets. An easy way to get started, and with the lowest fees, is to purchase ETH or BNB on Coinbase or Binance. Coinbase and Binance are “centralized exchanges”, or CEXs. This means that they can offer lower fees and are responsible for safeguarding your assets. You can already invest in various cryptocurrencies using ETH, BNB, or Bitcoin on these platforms. Buying your crypto from a CEX will literally save you thousands in the long run, as other platforms will charge you as high as 5% for buying crypto!

Buying Crypto on Binance

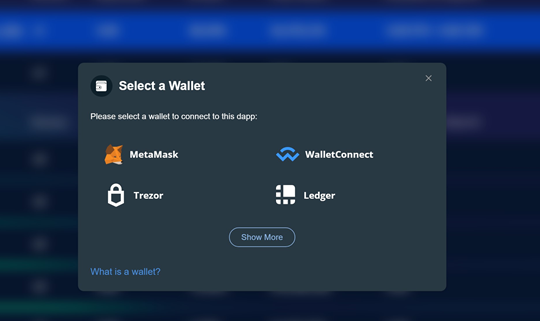

In order to interact with Decentralized Finance, you are going to need your own Private Wallet. We recommend Metamask, which you can install easily into your web browser. When you set up your Metamask, make sure you write down your private keys! If you do not, and if your computer is destroyed, you will never be able to recover your assets. With all of this set up, you are ready to start interacting with Decentralized Finance applications or any application that is a part of the “Web 3.0” movement. We also use Metamask for our i3D Angel NFTs as our Access Control mechanism to the i3D Data Marketplace

But this is just the tip of the iceberg

What if there was a way to earn 200%, 400%, or even 2000% interest on your crypto assets? And to reinvest your profits into other profit generating activities? There is a way, and it is called Yield Farming. Yield Farming is taking advantage of algorithmic-based lending pools to generate significant ROI. For instance, one platform (Goose Finance) allows for up to 2700% APY on your assets! But be careful as you need to know what you are doing and complete your due diligence before transacting.

Once you have Metamask installed, you can begin to experiment with yield farming. There are many platforms that allow for this, but we recommend Binance Chain based apps as they will have significantly lower transaction fees.

The next research report that we will provide will be a breakdown between the Ethereum and Binance networks, as well as how to install the Binance “smart-chain” on to your Metamask.

Key Terms

Yield Farming: Automatically staking or lending crypto assets in order to generate passive income.

CEX: Centralized exchanges for cryptocurrencies that are controlled and owned by a central party.

Private Keys: The backup phrases that are used to recover your wallet in the event that you lose your password or computer. Very NB!

Non-Custodial Wallet: A digital or physical wallet that you own personally to safeguard your crypto assets. Only you have access to these assets, and it is your sole responsibility to protect your wallet. If you lose your Private Keys to this wallet, you will never get your funds back, so be careful.

Web 3.0 Services: The future of the internet, where you can interact directly with websites or applications without the need for any central authority. The Decentralized Finance industry is a part of the Web 3.0 movement.

Centralized Finance: Financial services with centralized responsibility and control over deposited assets.

Stable Coins: Tokens pegged 1:1 to a certain value (i.e., 1 USD). Stable Coins maintain their stability by being backed up by real life assets or via algorithms.

Smart Contracts: Many blockchains allow for cryptocurrencies and applications to become programmable via “smart contracts”, circumventing the need for centralized authority or authorization and reducing settlement times.